October 3, 2023

What has been the focus in recent weeks

September was dominated by the central banks: while the US Federal Reserve (Fed) and the Swiss National Bank (SNB ) did not raise interest rates, the European Central Bank (ECB ) increased them by a further 25 basis points. None of this came as a big surprise. However, all three central banks have emphasized in their communications that interest rates will remain high for longer or could even be raised again. This unsettled the markets and depressed investor sentiment.

Rising oil prices – which gave rise to renewed fears of inflation – did the rest to increase volatility on the markets. Low inventories in the US and a deliberate tightening of supply by the Saudis were the main drivers behind these movements on the oil markets. The US dollar rose, benefiting from rising US yields and increased uncertainty about the future course of the global economy.

Our investment solutions

The renewed rise in yields on US government bonds has weighed on the global financial markets. As a result, our multi-asset strategies also suffered losses last month, driven by bonds, gold and equities. In addition to the rise of the US dollar against the Swiss franc, real estate also made a positive contribution with a price increase of almost 3 %.

However, our macroeconomic assessment has not changed. We therefore expect the financial markets to continue to recover over the coming months, which should have a positive impact on all asset classes. For the time being, we are sticking to our predominantly neutral positioning. However, as soon as the signs of the expected recovery are confirmed, we will reallocate to more cyclical investments in order to benefit disproportionately from the recovery.

As in August, the US dollar against the Swiss franc had a positive impact on the result of our 'Global Equity Trends' equity strategy in September – but the decline on the global equity market was even greater. This resulted in a decline of around 1 % at strategy level. The best month, and therefore also a positive contribution to the strategy, was made by the previously included energy stocks, which were the only sector to end September in positive territory.

Although the winners in August (large-cap quality and growth companies) were among the losers in September, they still have by far the strongest long-term upward trends. In this long-term view, utilities, followed by REITs and consumer staples, still bring up the rear. At the beginning of October, we entered into new exposures to financials at the expense of small-cap growth companies. With this step, we are focusing even more strongly on large-cap companies, i.e. on the driving forces of recent months.

In the 'Swiss Selection' equity strategy, the shares of Lonza and Straumann came under heavy pressure. At Lonza, the news of the resignation of CEO Pierre-Alain Ruffieux caused the share price to fall by almost 15 %. We will have to wait and see how the situation develops, but this will not change the substance of the company. Straumann, on the other hand, has lost favor with investors despite good figures for the first half of 2023. However, we expect this mistrust in the future prospects to be only temporary and see the current share price more as a buying opportunity.

Among the three heavyweights, Novartis shares were once again the frontrunners, followed by Nestlé and Roche. On a positive note: Our investments in the two smaller companies, Partners Group and Logitech, which actually gained in a negative market environment.

What next?

Overall, we are confident about the further development of the equity and bond markets in the coming months. However, we expect volatility to remain elevated in the coming weeks in particular, which is why we are taking a neutral position overall with a focus on quality.

What is particularly important at the moment?

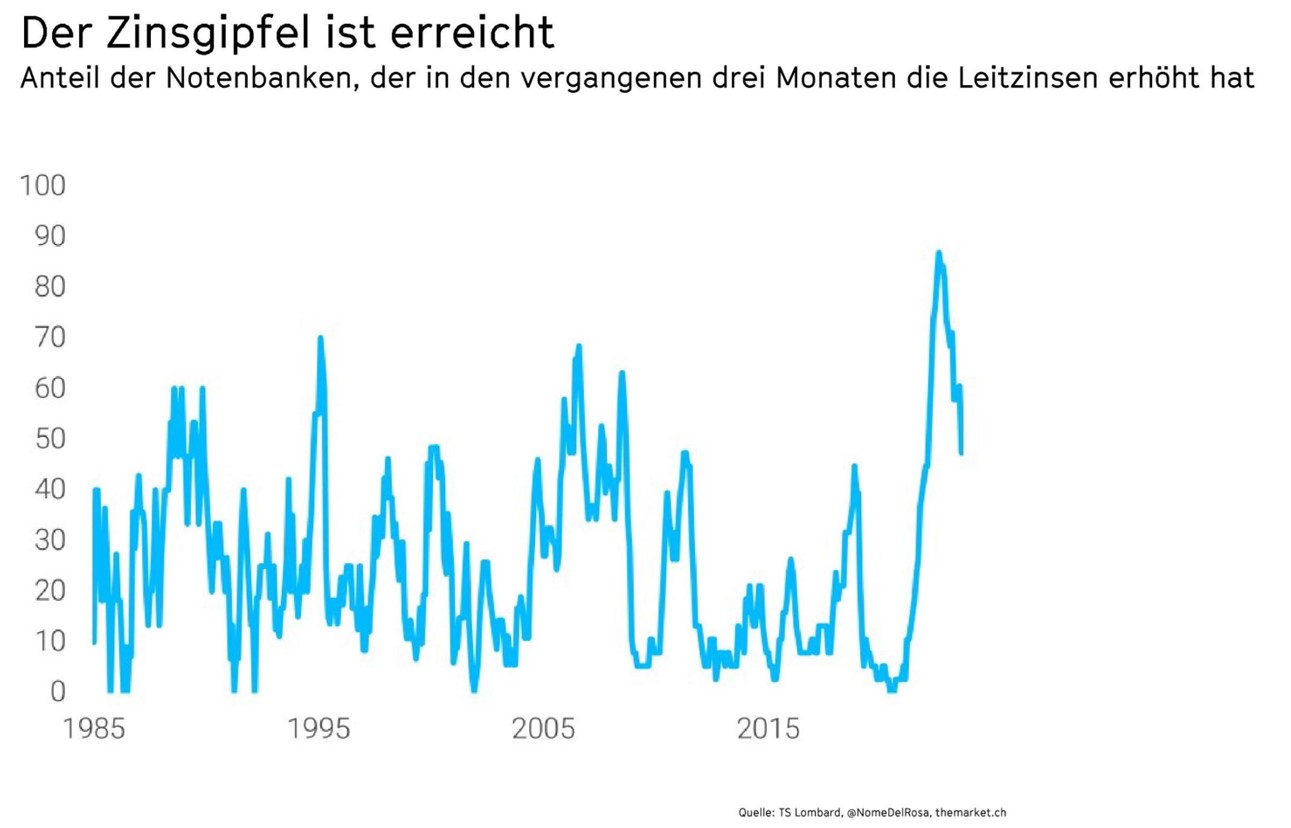

The central banks will remain in the spotlight in the coming weeks. And they are unlikely to give the impression that interest rates have peaked. That would jeopardize their most important asset – their credibility. But a look at the interest rate hikes by central banks around the world shows: The interest rate peak appears to have been reached. Given the current level of interest rates, we do not see much room for further increases.

Meanwhile, there are more and more positive signs on the inflation front. For the most part, it is declining or stabilizing worldwide. What is quite possible are so-called 'second-round effects', i.e. price increases in response to previous cost increases. Attention must be paid to this.

Further increases in oil prices could also pose a risk. However, it is unlikely that the Saudis will continue to tighten supply if the global economy suffers major setbacks as a result.

At the same time, we are seeing extremely strong labor markets in many parts of the world and correspondingly strong private consumption – which is the backbone of any economy. Meanwhile, earnings expectations for the coming reporting season are not particularly high and offer scope for positive surprises.

While some economic indicators are sending out negative signals, a particularly important leading indicator, the ISM PMI Purchasing Managers' Index in the US for September, has risen more strongly than expected and, at 49 points, is now only just below the growth threshold of 50 points. In this respect, let us not forget that the markets trade on expectations and not on facts. The stock markets generally anticipate economic developments by six to twelve months. The probability of a recession in the USA continues to decrease.

However, it is important to keep an eye on the so-called 'market breadth': Put simply, the share prices of smaller companies are still performing worse than those of large-capitalized companies. This suggests a certain caution on the part of market participants.

It should also be mentioned that a positive performance on the stock markets in the fourth quarter also fits in well with typical seasonal patterns. Such seasonal patterns can certainly be significant. This is particularly true in pre-election years in the US, such as this year.

Point Capital Group

3. October 2023