Dear reader

The year is slowly drawing to a close, and with the calendar waning comes the inevitable question, 'Where has my money gone?' It's that time again when we reflect on the future and consider the steps necessary to live a financially secure life. It's more than just the end of another year; it's a chance to focus on one of the most important – and often overlooked – issues in life: retirement planning.

Pension provision is more than just saving taxes

Many people recognize the value of a 3a account primarily as a means of saving tax. But it's about much more than that. It's about your future, your dreams and your security. At Point Capital, we recognize the importance of a solid retirement plan and have expanded our services. We are proud to now offer our clients individual pension solutions for both Pillar 2 in the form of vested benefits solutions and Pillar 3a.

Account vs. investment solution for your pension assets

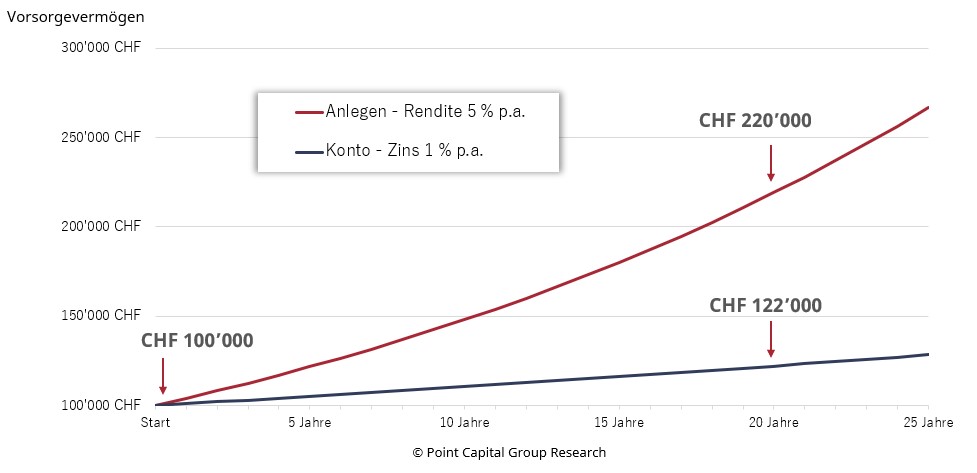

Have you ever wondered how much of a difference a small return on your pension assets can make? Here is a comparison between a traditional account solution with 1% interest and an active investment solution with an average return of 5%: You have pension assets of CHF 100,000 from pillar 3a or vested benefits. With the conventional savings solution, your pension assets grow to just over CHF 110,000 after 10 years and CHF 128,000 after 25 years. By comparison, with the investment solution, your original pension assets have already grown to just under CHF 150,000 after 10 years and you will receive just under CHF 270,000 after 25 years. The difference is striking and shows how powerful the compound interest effect can be, especially over a longer period of time. And the example also shows how important it is to actively look after your pension assets at an early stage.

Account vs. investment solution

Self-determined retirement provision

It's never too early to start thinking about retirement planning. In fact, it pays to start as early as possible. An early start gives your pension money more time to grow through the compound interest effect and ensures that you get the most out of your investment. Ultimately, retirement planning is a gift you give yourself. Not only does it secure your future, but it also gives you the confidence and peace of mind knowing that you are well positioned. At Point Capital, we are ready to guide you on this journey. Our new retirement savings services are designed to provide you with customized solutions for your individual needs. It's time to invest in your future. It's time for retirement planning.

Freedom of movement solutions – not only relevant for divorces

Who has or needs a vested benefits solution for their 2nd pillar pension assets? These are reasons for opening a vested benefits account:

- You are temporarily or for a longer period no longer in gainful employment.

- You are leaving Switzerland.

- You become self-employed.

- You have changed employer and do not want to contribute the entire amount to the new pension fund.

- You are entitled to a portion of your spouse's pension fund assets as part of divorce proceedings.

It's that simple

We have designed the entire process to be as streamlined as possible for you. We can open your account and custody account online if you wish. But of course we can also do this in a personal meeting. We will also take care of any transfer of existing pension assets.

With this in mind: Contact us and take the first step – we will take care of everything else for you. We will be happy to advise you.

Yours, Mark Stock©

Mark Stock is a member of the Point Capital editorial team. 'I am a stock market enthusiast and am passionate about economic history. I have been following the ups and downs of the markets for years and, of course, invest myself – preferably in shares. So my name says it all. Every month, I take up what I consider to be an exciting topic. And since the focus is on the content and not on me personally, I write under a pseudonym.'