Is it coming, is it not coming – or has inflation already returned? For the central banks in the industrialized countries, the rise in inflation is merely a temporary phenomenon. But what if they are wrong?

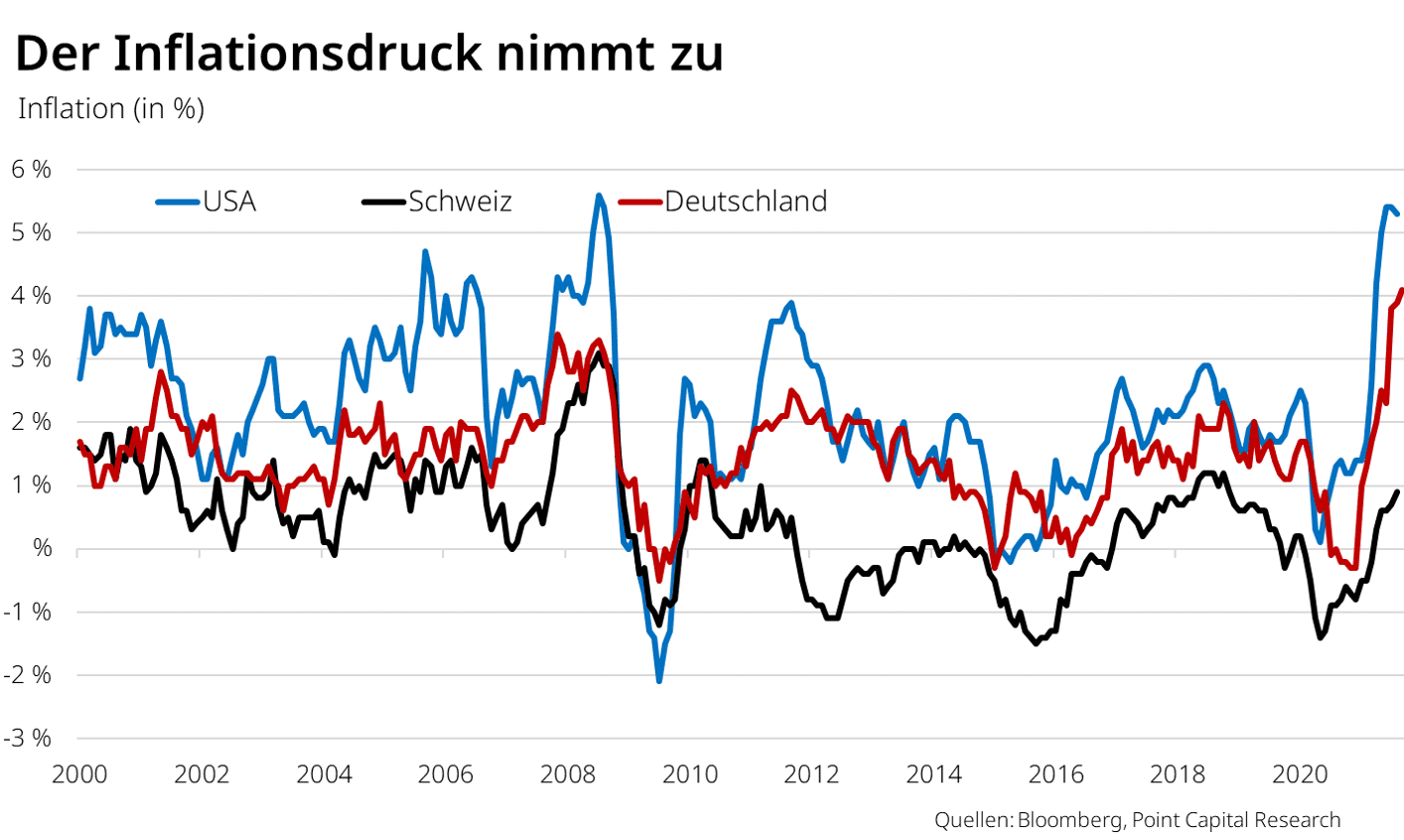

It is the dominant topic on the financial markets: what will happen to inflation? After years of low inflation rates, consumer prices have been rising steeply for several months. In the USA, the consumer price index has been consistently above 5% since June and in Germany it recently climbed by 4.1%, the sharpest rise in almost thirty years. With annual inflation of 0.9%, Switzerland is (still?) in a comparatively good position.

Really only temporary?

Such high inflation rates have not been seen in Europe and the USA for a long time. And if the central banks have their way, inflation will soon subside again. The price surge is only temporary, caused by so-called base effects in energy and commodity prices, supply bottlenecks and catch-up effects in consumption and investment that were postponed due to the pandemic. The spook should be over soon.

But what if the monetary authorities are wrong? There are some indications that inflation could be more persistent than hoped. Oil, natural gas and coal have risen rapidly in price in recent weeks. This will inevitably be reflected in consumer prices through rising production costs for companies. The trend towards globalization is also faltering. The return of protectionism, increasing trade conflicts and supply bottlenecks for key components are causing many companies to realign their supply chains. Instead of the cheapest possible production, the focus is on security of supply. This increases costs. The huge stimulus measures taken by many governments and the ageing population are also putting pressure on inflation. A calming of inflation is therefore anything but certain.

What should investors do?

How can investors prepare themselves? As a general rule, tangible assets such as real estate, commodities and

If you want to invest in bonds, you should consider inflation-linked bonds. Unlike the USA or Germany, however, Switzerland does not issue inflation-linked bonds. And in both countries, these bonds have negative yields and therefore only offer protection against a pronounced surge in inflation.

Shares have an advantage

Investors are better off with shares in the long term because companies can often pass on the price pressure to their customers. However, there are winners and losers in an inflationary environment. Historically, sectors such as construction, mining, chemicals and energy, which are particularly sensitive to the economy, have typically held the better cards when inflationary pressures have made themselves felt. Banks and other financial companies were also among the beneficiaries thanks to the steeper yield curve.

In the past, value stocks have generally outperformed pure growth stocks, as expensive growth stocks have often suffered from rising interest rates. Technology stocks are therefore particularly at risk. It is therefore important to consistently focus on quality in growth stocks. Precious metals such as gold and silver can round off a portfolio during periods of inflation.

Of course, the return of inflation is anything but certain, but the risk has increased noticeably. A little more inflation protection in the portfolio can therefore do no harm.

By Jules Kappeler

CEO of the Point Capital Group

October 5, 2021