Since March 2020, the US Federal Reserve has been diligently buying bonds to support the economy. Now it is hinting at a reduction in purchases. What does this mean for investors?

The date is approaching. For months, the US Federal Reserve has been telegraphing its intentions to begin tapering in the near future. It took the latest opportunity at the annual Federal Reserve meeting at the end of August, which was held virtually due to the pandemic and not in Jackson Hole, Wyoming, as usual. There, Federal Reserve Chairman Jerome Powell explained that it 'may be appropriate to begin tapering this year'.

What is it all about? The issue is that the monetary authorities could soon reduce the pace of their bond purchases – probably before the end of the year. This is because the Fed is still buying up government bonds and securitized mortgage bonds worth 120 billion dollars every month.

Measures to counter the economic slump

Why is it doing this? In addition to lowering key interest rates to 0%, these measures were adopted to support the economy immediately after the pandemic-related shutdown and to ensure that the markets function smoothly. They should be supplied with sufficient liquidity and their stability should be guaranteed.

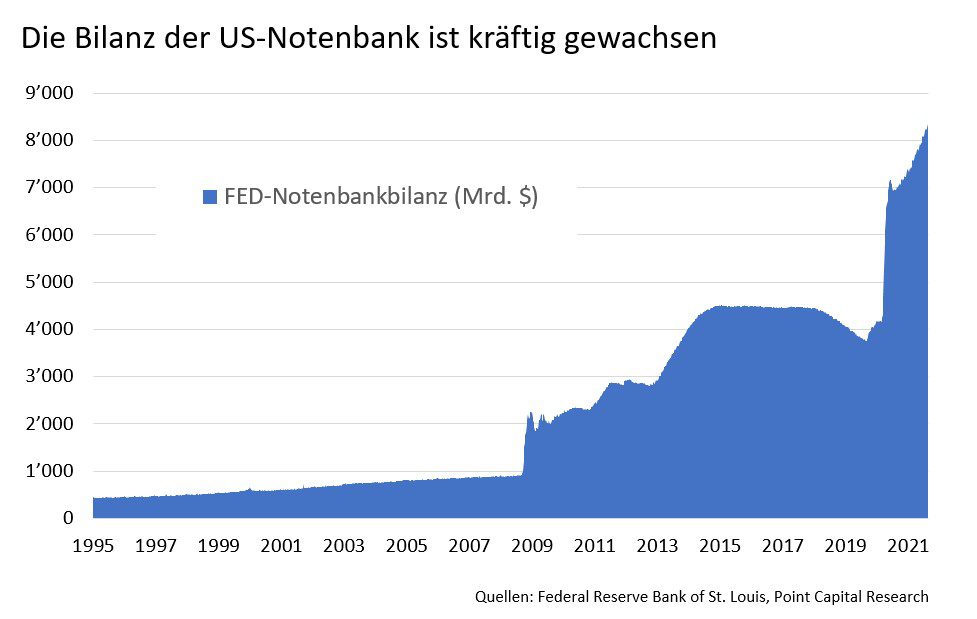

A look at the US Federal Reserve's balance sheet shows how extensively the Fed has recently purchased securities. Since March 2020 alone, the balance sheet has swelled from 4.2 to 8.3 trillion dollars has swelled. This corresponds to 37.5% of the entire US gross domestic product.

Economy has recovered

However, the economy is now on the road to recovery. The US is one of the few economies whose economic performance is now exceeding pre-pandemic levels again. Unemployment has fallen from around 13% to below 6%, consumer demand is robust and the sharp rise in inflation in particular is increasingly raising doubts as to whether these securities purchases are still justified. The voices of those warning of overheating and financial instability are growing louder.

In order to keep all options open and to gauge how the stock markets react, Jerome Powell has not yet given an exact date for when the tapering will begin. However, the consensus in the market expects tapering to begin this year.

No interest rate hike yet

What this means for the markets cannot be said with certainty. What can be said, however, is that the Fed's securities purchases have helped to support the markets.

If the support is now gradually reduced, the bond markets are likely to react with a rise in yields, which could – at least temporarily – lead to somewhat rougher stock markets. Overall, however, liquidity conditions remain ample, which is why the stock markets should be able to cope well with the tapering. Finally, the scaling back of stimulus measures is also a sign that the Fed believes that the economic recovery is robust enough and that the markets can function under their own steam.

Especially as Jerome Powell emphasized that the reduction was not yet an indication of an imminent interest rate hike. These cautious words were very much to the taste of the stock markets. The market now expects the first interest rate hike to take place in 2023 at the earliest.

By Jules Kappeler

CEO of the Point Capital Group

September 3, 2021