August 8, 2023

'Downgrading the USA: it's all half as bad!'

What has been the focus in recent weeks

It's reporting season once again: companies are communicating their results for the second quarter. Almost 90 % of the largest companies in the USA have already reported. Share prices fell by an average of 0.8 % after publication. The cautious statements regarding developments in the coming quarters had a negative impact. The situation was different in Switzerland, where only around 50 % of listed companies published their figures: on average, their shares rose by 2.4 % immediately afterwards.

Apple disappointed with overall mixed figures and a subdued outlook and now has a market capitalization that is once again below the USD 3 trillion mark – which it had recently broken as the world's most valuable company. Meanwhile, Amazon was able to surprise positively on practically all levels: Sales and margins performed better than expected and Amazon's cloud division continues to do very well. Tesla was also able to report record results: New sales records were achieved in numerous markets. In Germany, for example, Tesla sold more electric cars in the first half of the year than Volkswagen, BMW, Mercedes and Porsche combined.

The presentation of the results of Nvidia, one of the largest chip manufacturers and with a particularly strong market position in high-performance chips, on 23 August is eagerly awaited. Nvidia has benefited greatly from the boom in AI (Artificial Intelligence) in recent months. It will be extremely interesting to see what results and outlook the company presents.

The central banks' interest rate policy continues to be a major concern for the markets. Both the US Federal Reserve and the European Central Bank (ECB) recently raised their key interest rates by 0.25 % each, which was generally expected.

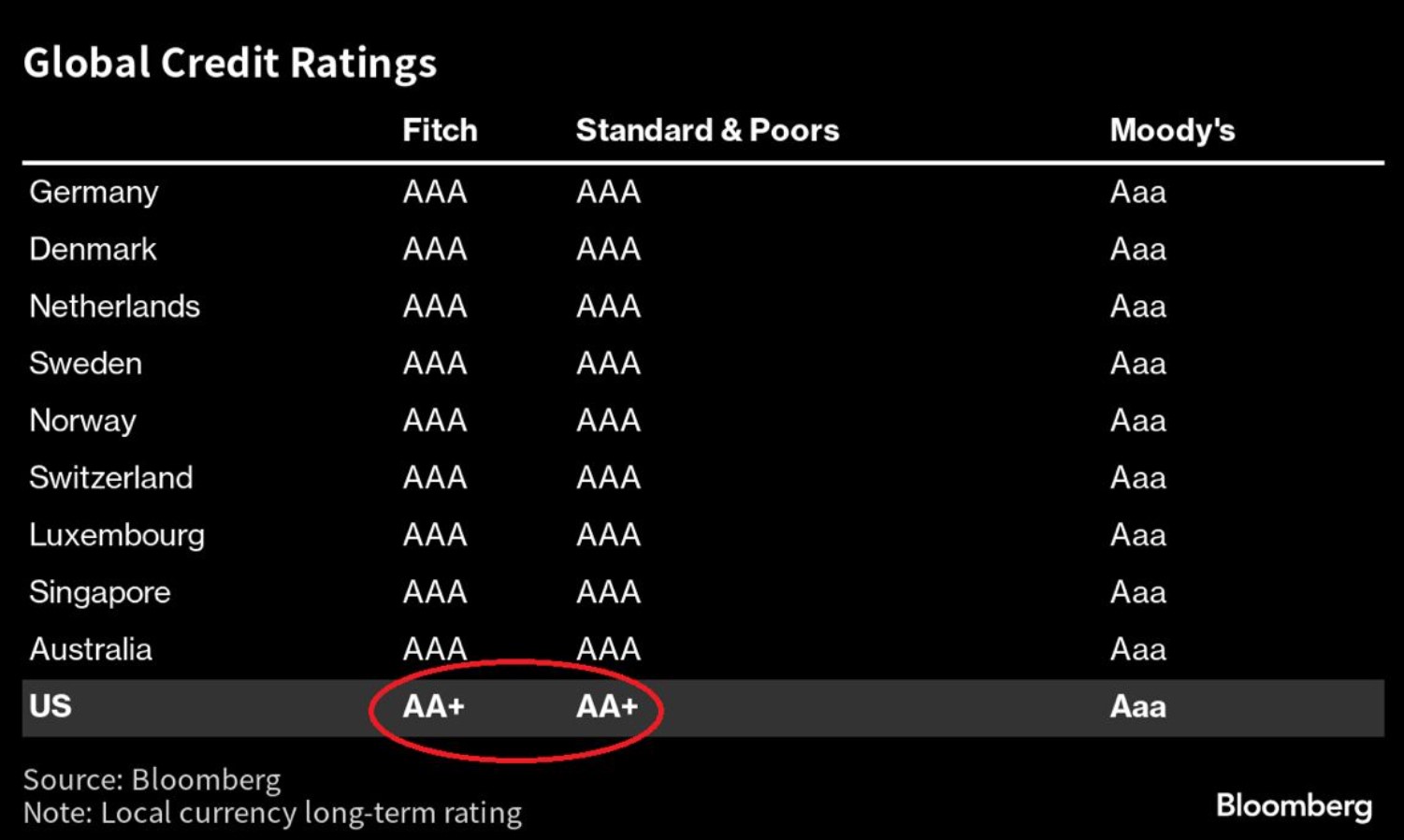

The downgrading of the USA by the renowned rating agency Fitch was a talking point: the USA is now 'only' rated AA+ and no longer the top rating of AAA. It was another well-known rating agency, Standard & Poor′s, which had already withdrawn the top rating from the USA in 2011. It was interesting to see that in the following six months, the broad-based US share index S&P 500 rose by 12% and even by 16% within a year.

Our investment solutions

The equity component of our multi-asset strategies has come under pressure. Although the equity markets themselves made a positive contribution, this was offset by the strong Swiss franc. Bonds fulfilled their stabilizing function and alternative investments in the form of gold had a positive impact on the monthly result. This was not least because we hedged these asset classes against currency losses. We are currently sticking to our current positioning. However, we are preparing to give the portfolios a slightly more cyclical orientation as soon as the global economic environment provides appropriate signals.

In our 'Global Equity Trends' equity strategy, investments in communications and commodities stocks have paid off in recent weeks. However, the fall in the USD against the Swiss franc has also affected us. The previous top sectors – technology, cyclical consumer goods and small caps – have been less convincing recently, although cyclical consumer goods and technology stocks in particular are still showing strong upward trends. Since the beginning of this month, we have been investing in industrial companies instead of financials, and in the small caps sector we are focusing on high-growth companies. We continue to see the strongest long-term trends in the technology sector and in high-growth companies in general, while utilities bring up the rear.

In the Swiss equity strategy 'Swiss Selection', the shares of Partners Group and Logitech recorded the highest gains. Both are thus fully on track in their turnarounds and we expect a positive development in the future as well. In our view, profit-taking would therefore be premature at this stage. The two Swiss heavyweights, Nestlé and Roche, are still struggling to break their respective downward trends. This is also having a considerable impact on the Swiss Market Index. Novartis is currently in a much better position, especially compared to its competitor Roche, and was able to surprise positively when it recently presented its quarterly figures. In principle, we remain positive about the Swiss equity market and are maintaining our somewhat more dynamic stance.

What next?

Statistically speaking, August and September tend to be weak months on the stock markets before the markets regain momentum towards the end of the year. Such seasonal patterns can certainly be significant. This is particularly true in pre-election years in the USA, such as this year.

On a macro level, economic data, in particular inflation and employment figures, are closely watched. In the short term, all eyes will therefore be on August 10, when the US inflation data for July is published. This will play a key role in determining whether the Fed will raise interest rates again or whether the peak in interest rates has already been reached and a possible turnaround in interest rates is imminent. The next important central bank meetings are scheduled for September, both in the US and in Europe.

And as I said, August 23 will be particularly interesting when Nvidia presents its figures and thus lifts the veil, so to speak, on the major topic of AI. Nvidia's share price has already more than tripled since the beginning of the year and has thus already more than compensated for the major losses of last year.

Point Capital Group

8. August 2023