The economy is picking up speed – worldwide. How the impending upturn is also driving inflation in Europe.

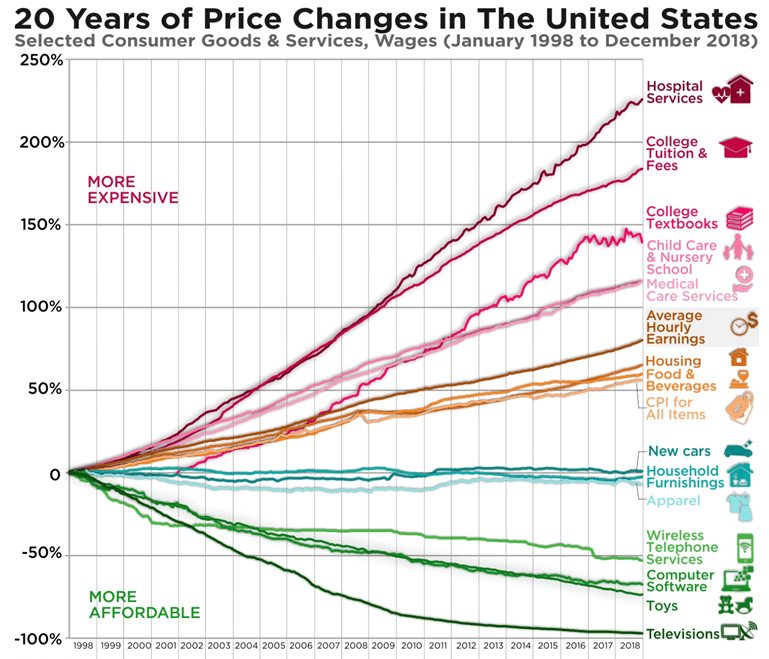

If we look at price trends in various American industries from 1998 to the end of 2018, the following is striking: Goods such as televisions, computers, telephones and toys have become dramatically cheaper over the years. On the other hand, the prices of services in hospitals, schools, universities and daycare centers have risen steadily. How can this discrepancy be explained?

Source: howmuch.net

Inflation in the service sector is based on the fact that the largest cost factor in these industries is wages and salaries. Prices directly follow the constant increases in wages and salaries. Productivity gains of the same magnitude as in the production of goods are not achieved in the service sector. A nurse, teacher or professor cannot look after more patients, pupils or students in the same amount of time. This is why rising wages and salaries are directly reflected in rising prices. So what does this mean?

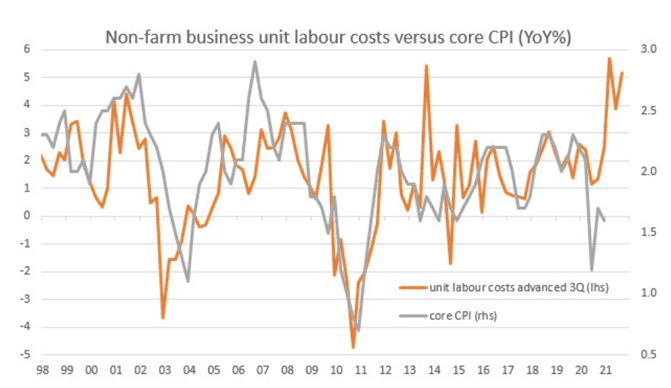

Unit labor costs can therefore be directly linked to the inflation rate. I show this using the example of the USA: the core inflation rate (inflation) follows unit labor costs (excluding agriculture) with a three-quarter lag. To illustrate this dependency, the graph below shows unit labor costs lagged by three quarters (orange line).

Source: Macrobond, ING

Increases in wages and salaries therefore shape the course of the inflation rate. Increases in wages and salaries are the result of supply and demand, among other things. When the economy is doing well and the unemployment rate is low, employees and job seekers are in a favorable position and can demand higher wages. During an economic downturn with high unemployment, however, there are more jobseekers available for every job on offer, meaning that wage and salary expectations are not so easy to enforce.

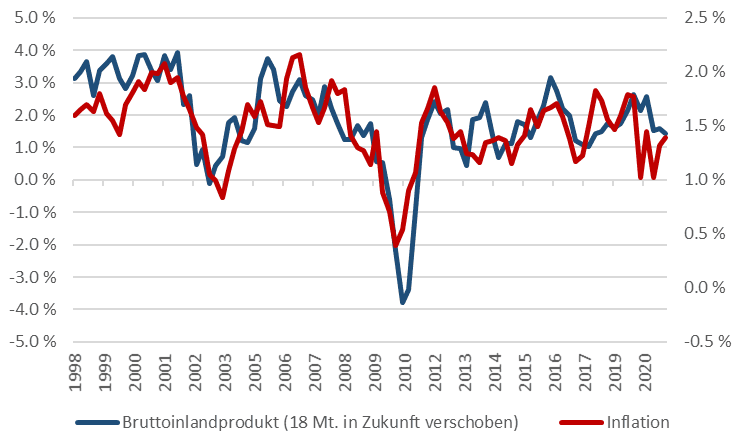

In the next chart, I have superimposed the rate of change in gross domestic product in the USA 18 months into the future over the rate of change in core inflation.

Rate of change in inflation and GDP

Source: Point Capital Research

This chart thus establishes the connection that a healthy economy causes unit labor costs to rise with a three-quarter lag, which in turn pushes up the core inflation rate with a three-quarter lag.

What can we conclude from this?

This link makes it possible to make a reasonable forecast of the inflation rate over the next few years. Bank of America estimates that the major spending programs of the new US President Joe Biden will boost economic growth to six percent next year. If we look again at the last chart, this would lead to an inflation rate of three percent 18 months later, i.e. in 2024. We must therefore expect a noticeable rise in inflation in the USA and therefore probably also in Switzerland and Germany over the next few years.

From this point of view, an investment is all the more imperative. If you leave your

From Thomas Gebert

Board of Directors of Point Capital Group

Stock market expert and multiple author

9. March 2021