Swissness is known to stand for quality – but on the stock market too? It is worth taking a look at the performance of various country indices. This is how Swiss shares actually perform.

When it comes to investing in equities, investors are often faced with the question of which markets are the most attractive. The Swiss equity markets offer a combination of quality, stability and long-term returns that make them an interesting choice.

Point Capital, your partner for asset management with optimized security, helps you to make the most of the advantages of Swiss equities and to invest your shares sensibly for the long term.

The development of the Swiss equity market

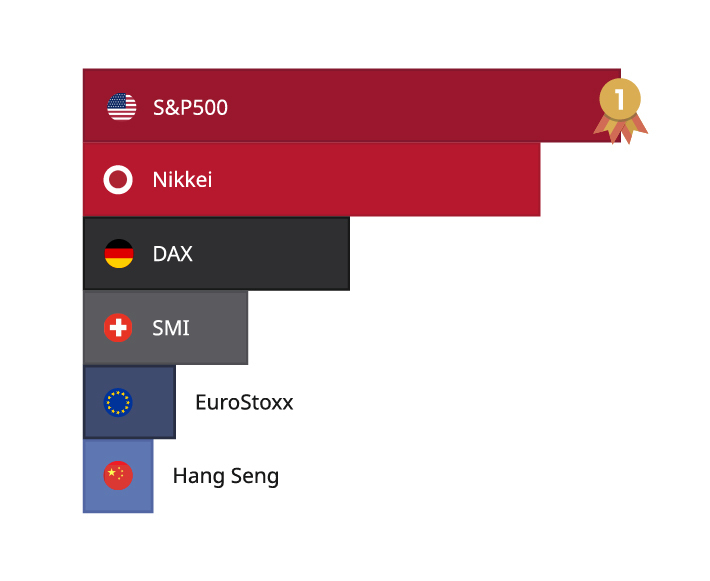

Who hasn't had this experience themselves: you prefer things that you know, that are simply more familiar to you than others. But anyone who focuses solely on Swiss stocks when buying shares is missing the point. Because the answer to the question of whether Swiss shares are the best, especially in comparison with international securities, is a clear 'no'. A look at the performance of various country indices from 2015 to 2024 clearly demonstrates this:

Performance of country indices over 10 years

The chart shows that US equities have significantly outperformed all others. From 2015 to 2024, the S&P 500 gained around 250% in total, which corresponds to an annual gain of more than 13%. The Swiss SMI only comes second to last in this comparison – behind the European stock markets.

Why are US equities performing so well? What are the reasons for the unflattering ranking of Swiss equities? And how do you achieve good equity returns on the Swiss market? Find out more in this article.

Advisor

Investing in stocks: the right strategy for attractive returns

- which criteria are important when selecting stocks.

- what the debate between 'growth' and 'value' is all about.

- why a structured investment strategy is essential for success on the stock market.

Ideally, don't just buy Swiss shares

One important insight first: an international focus on the stock market is important when putting together an equity portfolio. This opens up more interesting opportunities that would otherwise be missed. The Swiss market is manageable. In addition, risks can be reduced by buying shares in different regions of the world.

An impressive figure clearly shows how much leeway there is when investing money, which investors should definitely make use of:

The combined market capitalization of all Swiss companies is less than 3 % of the global market capitalization. In other words: 97 % will not be tapped if you only invest in Switzerland.

Interesting Swiss equities: liquidity and trading volume

The Swiss equity markets are characterized by high liquidity, which is underlined by the trading volume on the SIX Swiss Exchange. The Swiss Market Index (SMI) comprises the twenty largest and most liquid companies, which ensures efficient tradability.

Our experts will show you how to make the most of the advantages of the Swiss stock market. Our well thought-out investment strategies will help you achieve ideal results on the stock market.

Recommendations and advice on Swiss equities from Point Capital

However, anyone who does not feel confident in unfamiliar territory, i.e. foreign markets, can seek advice. At Point Capital, we combine the advantages of the foreign market with those of Swiss securities. We invest your money in quality shares worldwide – for your financial freedom. Invest with us in quality Swiss equities and high-quality securities worldwide!

Consultation appointment

Learn more and get personal advice – free of charge and without obligation.