September 5, 2023

What has been the focus in recent weeks

The reporting season for the second quarter is over and showed a positive overall picture, albeit a mixed one in some cases. There was a particular focus on the eagerly awaited figures from Nvidia, a major chip manufacturer whose shares had literally taken off in the wake of the AI(artificial intelligence) hype. Nvidia was even able to exceed the very high expectations overall. The company appears to be one of the few large companies that can benefit directly from AI with its business model. However, it remains to be seen how sustainable this trend will be. After all, AI is not really a new topic and a look at other earlier trends such as blockchain shows that a trend cannot simply continue in a linear fashion.

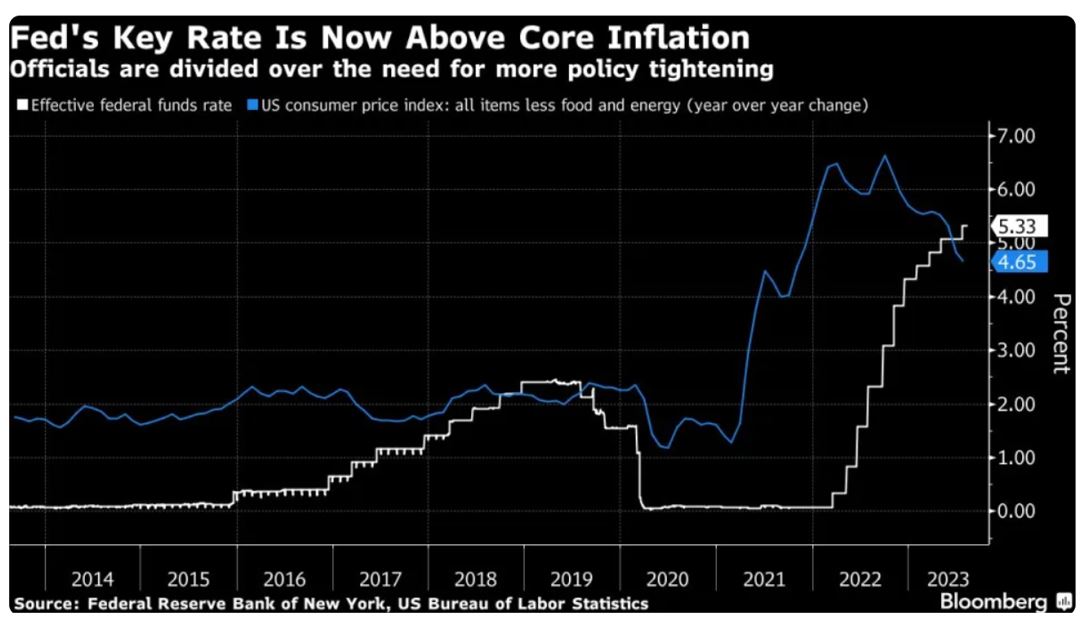

And then there was the meeting of the world's most important central bankers in Jackson Hole in the USA. The speech by Jerome Powell, Chairman of the US Federal Reserve, was particularly eagerly awaited. 'The job is not yet done', he said, referring to the persistently high level of inflation. However, there was also talk of 'proceeding with caution' and so Powell sent out mixed signals overall, allowing for various interpretations. The next dates for the central banks' interest rate decisions are therefore eagerly awaited: On September 14, it will be the turn of the ECB European Central Bank, on September 20 the Fed and one day later the SNB Swiss National Bank.

Put simply, everything on the capital markets depends on interest rates. The interest rate level determines which asset class is in demand and which is not. Gold, for example, has a hard time when interest rates rise, as it does not yield any interest. Gold, on the other hand, can benefit when interest rates fall (again). And when it comes to equities, shares in growth companies, which are primarily betting on rising profits in the future, tend to be less in demand when interest rates rise. We have seen this very clearly over the past year. When interest rates rise, the value of future profits is worth less today than when interest rates fall. But as always on the stock markets, it is expectations that are traded, not facts. The markets generally anticipate developments 6-12 months in advance and so the only relevant question when it comes to interest rates is: where do market participants see interest rates in 6-12 months' time?

We assume that key interest rates in the USA, the eurozone and Switzerland will not rise any further, or at best only slightly. Although the labor markets are remarkably strong in all three economic areas, many economic indicators have continued to weaken. Inflation is also continuing to fall. Overall, this suggests that the end of interest rate hikes has been reached. In addition, the key interest rate in the USA is already higher than core inflation (see chart).

Our investment solutions

In our multi-asset strategies, we sold European automotive shares at the beginning of August and instead increased our exposure to the Swiss equity market. On the one hand, this led to a reduction in foreign currencies in favor of the Swiss franc and, on the other hand, this shift made the focus somewhat more defensive. August can be summarized as follows across many asset classes: A weak first half followed by a recovery in the second half of the month. Once again, this movement can probably be attributed to the development of US interest rates.

The performance of the US dollar against the Swiss franc had a positive impact on the overall result of our 'Global Equity Trends' equity strategy last month, but was unable to fully offset the decline on the global equity market. The strategy's top performers included large-cap companies as well as quality and growth companies. The worst monthly results were recorded by shares from the consumer discretionary sector (e.g. Nike or Louis Vuitton) as well as commodities and basic materials. Thanks to the stable performance of recent weeks and months, energy stocks also qualify for inclusion in the portfolio again. This reallocation is taking place at the expense of industrial companies. We see few changes in the medium term, as the strongest trends are still in technology and communications companies and the utilities sector is still in the red.

Not least thanks to the convincing quarterly result, UBS shares took the top spot in the 'Swiss Selection' equity strategy in August, followed by Alcon and Nestlé. The negative signals coming from China in recent weeks put renewed pressure on the luxury goods manufacturer Richemont. Among the Swiss heavyweights (Nestlé, Novartis and Roche), the latter is still struggling the most, while its direct competitor Novartis is the most promising. We expect the overall market to continue to develop positively and therefore remain somewhat more dynamic.

What next?

Statistically speaking, September is a weak month on the stock markets before they pick up momentum again towards the end of the year. Such seasonal patterns can certainly be significant. This is particularly true in pre-election years in the USA, as is the case this year. The markets are waiting for new news and corresponding impetus from the central banks: the Fed, the ECB and the SNB will announce their interest rate decisions in September. We expect the interest rate hikes to come to an end before the end of the year. The equity markets have a good chance of benefiting from this.

Point Capital Group

5. September 2023