November 7, 2023

What has been the focus in recent weeks

Uncertainties in connection with the Middle East conflict, the oil price and the Fed' s course have moved the markets in recent weeks. In addition, companies reported their results for the third quarter – with good figures overall and a largely positive outlook, albeit with major differences between individual companies and sectors. Of the major stocks in the US, Amazon, Netflix and Microsoft, for example, were able to surprise positively, while Alphabet (Google) and Apple were rather disappointing. It should be noted that these two companies are also literally bursting with strength, but to a lesser extent than the market had expected.

The markets were correspondingly volatile, as expected in our last market commentary. The US economy remained strong, even if there were signs of a slowdown here and there. At the same time, inflation is falling and the Fed has therefore not tightened interest rates any further – a combination that has been particularly well received by the markets in recent days.

Our investment solutions and positioning

In our multi-asset strategies, we sold investments in consumer staples in October and made new investments in global quality stocks instead. Quality companies generally offer opportunities in all market situations. Otherwise, however, we kept our positioning unchanged. Following the strong performance of the US dollar against the Swiss franc in September, we have seen the US dollar fall again in recent weeks, although this is more of a corrective nature. There was a pleasing development in gold. After losing favor with investors in the last few days of September, gold has already more than made up for this decline.

The second half of October hit the equity markets hard, and our Global Equity Trends strategy was not spared. However, thanks to our positioning in trendy sectors, the decline was less pronounced. For example, technology stocks have again been among the winners in recent weeks and, together with companies from the communications sector, continue to show the strongest upward trends on an annual basis. At the turn of the month, we disposed of companies in the commodities sector and medium-sized growth stocks, among others. New additions were made in the healthcare and value sectors. We therefore continue to favor large-cap companies from various sectors.

Thanks to encouraging quarterly figures, Logitech was the clear high-flyer in our 'Swiss Equity Selection' equity strategy, followed by Zurich Insurance and Givaudan, the world's largest manufacturer of flavors and fragrances. All three have had a positive impact on performance in recent weeks. On the other hand, Lonza unfortunately suffered another decline. This was after investors had probably hoped for a little more from the Investors' Day. Sandoz celebrated its stock market debut at the beginning of October following its spin-off from Novartis. After a brilliant start, however, these shares also came under pressure in the second half of the month, along with the Swiss stock market as a whole. The latter even slipped below its level at the beginning of the year, but should be able to recover from these levels.

In our global equity selection 'Global Equity Selection', the last few weeks have been characterized by the publication of quarterly figures. Although most of these have been well received, there have also been a few setbacks. West Pharmaceutical Services and Edwards Lifesciences, for example, failed to convince investors in the short term. On the other hand, Arista Networks' quarterly figures were celebrated with a share price jump of over 10 %. We also sold Coloplast in October. This was because we see lower potential for the future for company-specific reasons. Costco Wholesale is a new addition to the portfolio. Thanks to its defensive orientation and very good quality, this retail company is an ideal addition to the existing portfolio with opportunities in practically every market environment.

What next? And what needs to be considered?

We are looking ahead to 2024 and positioning ourselves accordingly. It is currently a good time to build up or add to portfolios. We do not expect a so-called 'hard landing' for the US economy or a severe, widespread recession in Europe. At the same time, inflation should continue to fall. As outlined in our last market commentary, we continue to believe that interest rates have probably peaked. We expect central banks to cut interest rates in 2024. Accordingly, there are opportunities for both equities and bonds next year. In order to manage unforeseeable risks, we continue to recommend a strong focus on quality. For equities, this means solid balance sheets with low debt, high profitability and business models with strong market positions and strong brands. For bonds, we only focus on investment-grade bonds. In terms of currencies, we particularly favor the Swiss franc.

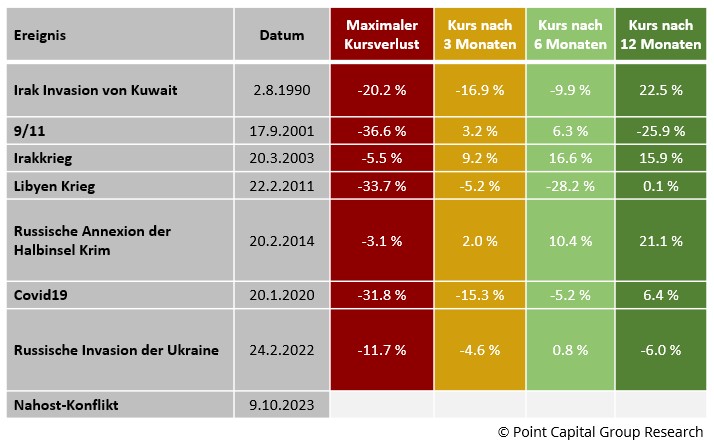

Investors should not focus too much on the Middle East conflict right now. Such conflicts harbor clear risks, but investors generally overestimate the impact of geopolitical conflicts on the markets (see chart below). It is fitting, for example, that the oil price is already trading lower than before the start of the current Middle East conflict.

Geopolitical conflicts – the markets recover quickly

It should also be mentioned that a positive short-term trend on the stock markets in the coming weeks could fit in well with typical seasonal patterns. Such seasonal patterns can certainly be significant. This is particularly true in pre-election years in the US, such as this year. Finally, in mid-December, the US Federal Reserve will meet again and announce its assessment – this will influence the markets for the last few weeks of the year. We do not currently expect the Fed to raise interest rates any further. This would provide good conditions for the markets and a correspondingly positive end to the year.

Point Capital Group

7. November 2023